Exam Oriented Essential Facts

# Most essential for Prelims Exam

* Most essential for Mains Exam

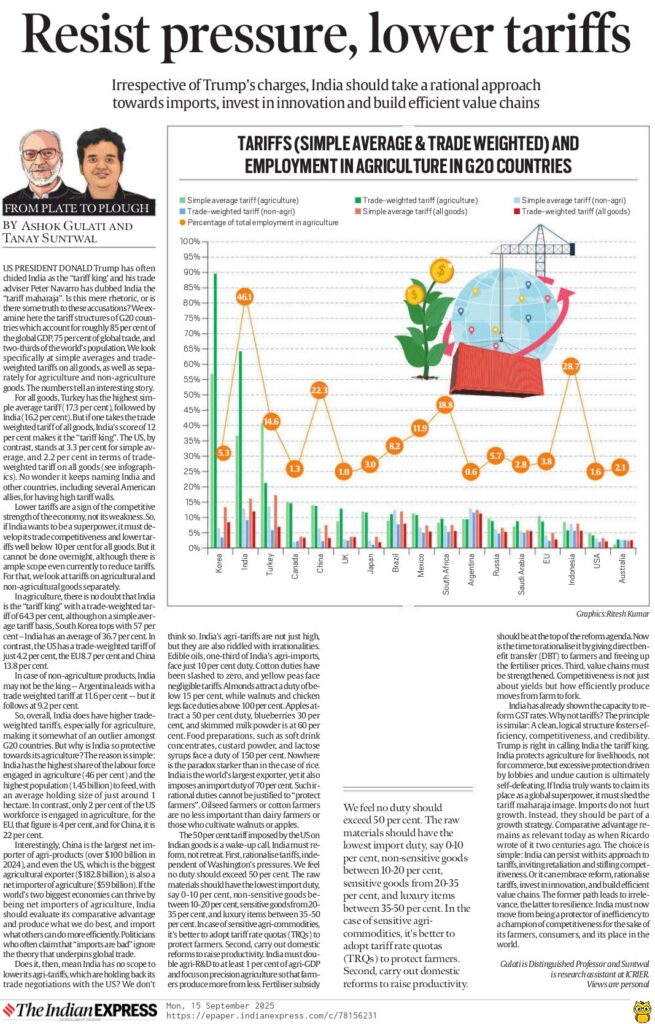

- The tariff structures of G20 countries which account for roughly 85 per cent of the global GDP, 75 per cent of global trade, and two-thirds of the world’s population. (Empirical Fact)

- For all goods, Turkey has the highest simple average tariff (17.3 per cent), followed by India (16.2 per cent). (Verified Fact)

- Lower tariffs are a sign of the competitive strength of the economy, not its weakness. So, if India wants to be a superpower, it must develop its trade competitiveness and lower tariffs well below 10 per cent for all goods. For that, we look at tariffs on agricultural and non-agricultural goods separately. (Expert’s Prediction, Empirical Fact)

- In agriculture, there is no doubt that India is the “tariff king” with a trade-weighted tariff of 64.3 per cent, although on a simple average tariff basis, South Korea tops with 57 per cent – India has an average of 36.7 per cent. In contrast, the US has a trade-weighted tariff of just 4.2 per cent, the EU 8.7 per cent and China 13.8 per cent. So, overall, India does have higher trade-weighted tariffs, especially for agriculture, making it somewhat of an outlier amongst G20 countries. (Verified Fact)

- But why is India so protective towards its agriculture? The reason is simple: India has the highest share of the labour force engaged in agriculture (46 per cent) and the highest population (1.45 billion) to feed, with an average holding size of just around 1 hectare. In contrast, only 2 per cent of the US workforce is engaged in agriculture, for the EU, that figure is 4 per cent, and for China, it is 22 per cent. (Assertion-Reason, Verified Fact)

- China is the largest net importer of agri-products (over $100 billion in 2024), and even the US, which is the biggest agricultural exporter ($182.8 billion), is also a net importer of agriculture ($59 billion). (Verified Fact)

- India’s agri-tariffs are not just high, but they are also riddled with irrationalities. Edible oils, one-third of India’s agri-imports, face just 10 per cent duty. Cotton duties have been slashed to zero, and yellow peas face negligible tariffs. Almonds attract a duty of below 15 per cent, while walnuts and chicken legs face duties above 100 per cent. Apples attract a 50 per cent duty, blueberries 30 per cent, and skimmed milk powder is at 60 per cent. Food preparations, such as soft drink concentrates, custard powder, and lactose syrups face a duty of 150 per cent. Nowhere is the paradox starker than in the case of rice. India is the world’s largest exporter, yet it also imposes an import duty of 70 per cent. (Verified Facts)

India must reform, not retreat. First, rationalise tariffs, independent of Washington’s pressures. The raw materials should have the lowest import duty, say 0-10 per cent, non-sensitive goods between 10-20 per cent, sensitive goods from 20-35 per cent, and luxury items between 35-50 per cent. In case of sensitive agri-commodities, it’s better to adopt tariff rate quotas (TRQs) to protect farmers. Second, carry out domestic reforms to raise productivity. India must double agri-R&D to at least 1 per cent of agri-GDP and focus on precision agriculture so that farmers produce more from less. Fertiliser subsidy should be at the top of the reform agenda. Now is the time to rationalise it by giving direct benefit transfer (DBT) to farmers and freeing up the fertiliser prices. Third, value chains must be strengthened. Competitiveness is not just about yields but how efficiently produce moves from farm to fork. (Assertion- Reason; Empirical Fact)

India has already shown the capacity to reform GST rates. Why not tariffs? India protects agriculture for livelihoods, not for commerce. (Assertion-Reason; Subjective Fact)

- India must now move from being a protector of inefficiency to a champion of competitiveness for the sake of its farmers, consumers, and its place in the world. (Concluding Statement)

About Different Facts:

Objective Facts: Based on evidence and empirical data that can be verified.

Subjective Facts: Based on opinions or beliefs, rather than verifiable evidence.

Verified Facts: Information validated against authoritative sources, though the standard of evidence may be lower than for scientific facts.

Empirical Facts: Facts derived from direct observation and experience.

Brute Facts: It is a fact that has no explanation; it is fundamental and cannot be explained by a deeper or more fundamental fact.

Consensus Facts: The idea that something is considered true if a large group of people believes it is. This is relevant to subjective areas like society, culture, and art, where objective measurement is not possible.

Author: currentaffairs4upsc

UPSC